MSCI: The Rockstars of Investment Scorekeeping

From Business Model to Valuation: A Dive into MSCI

Quick reminder : I recently released a book called "Investing with Eagles." 🦅 It dives deep into the strategies I've used to navigate the market and achieve my own financial goals. For our launch offer we’re dropping the price to 12,99$ for the paper version and 9,99$ for the kindle version. If you're ready to soar to new heights, check it out on Amazon.

MSCI: The Rockstars of Investment Scorekeeping 🎸📊

Think of MSCI as the ultimate scorekeeper for the investment world. They're not actually in the game, throwing money around. Nope, they're the folks behind the scenes, meticulously tracking everything and telling everyone how well (or not so well!) the players are doing. Imagine them as the cool, data-smart nerds who make sure everyone else in finance knows what's up. They've been doing this since way back in the groovy 60s, so they're like the veteran legends of financial data. And get this – they're currently keeping score for over $14 TRILLION in investments! That's more zeros than you can count on your fingers and toes, like, a gazillion times over! 🤯

Money, Money, Money: MSCI's Business Gig 💰

So, how does this scorekeeping gig turn into a money-making machine? Think of it like a subscription box, but for serious finance folks. Clients sign up for the MSCI magic and get a steady stream of awesome stuff, mostly on repeat. It's like Netflix, but instead of movies, you get super valuable financial intel. Here’s the breakdown of their money-making hits:

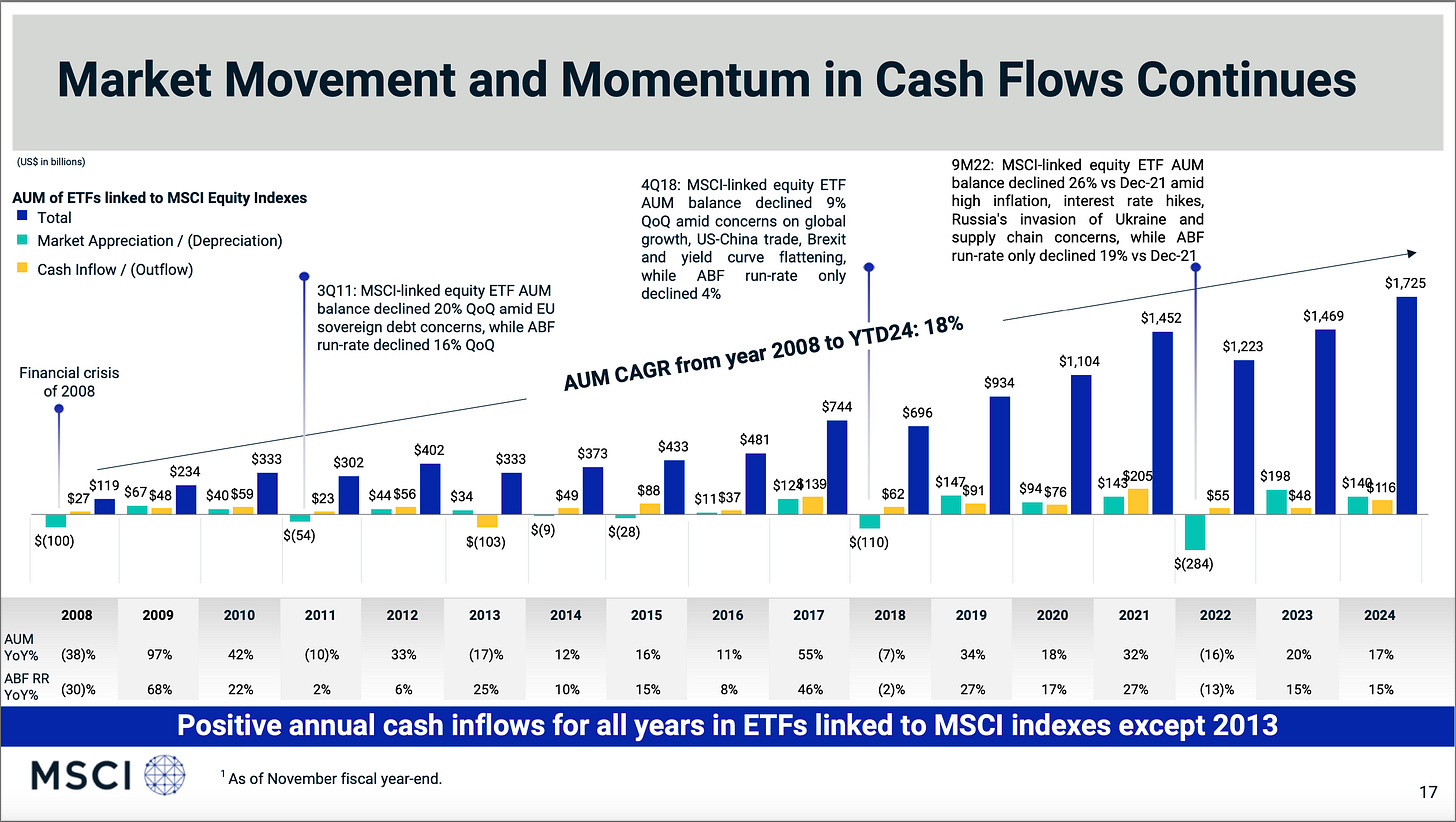

Index Licensing - The Headliner: Imagine MSCI creates the "charts-topping hits" of indices. ETFs and investment funds are like the bands that license these hits to create their albums (investment products!). In 2022, licensing these index hits made up about 25% of their total cash flow. That's like the main song everyone's downloading! 🎧

Subscription Services - The Loyal Fanbase: This is the bread and butter. Clients pay for the ongoing VIP access to MSCI's data party and analytics platform. Think of it as a monthly pass to the coolest financial club. 🔑

Analytics & Research - The Deep Cuts: MSCI also offers super smart tools to manage risks and build killer investment portfolios. It's like having a financial GPS and architect all in one! 🗺️

Custom & Syndicated Reports - The Special Editions: Need a report tailored just for you, or a standard industry deep dive? MSCI's got the special edition vinyls and collector’s magazines of financial research. 📰

Consulting & Pro Services - The Roadies: MSCI's pros are like the roadies for finance, helping clients set up and rock their investment strategies. 🎸

Data APIs - The Tech Hookup: Want MSCI's brainpower plugged straight into your own systems? They offer data APIs for a direct data download. 💻

Benchmark Reporting - The Performance Review: Did your investments nail it or fail it? MSCI helps clients see how they stack up against the benchmarks. 🏆

ESG Data & Ratings - The Conscious Investor's Guide: Want to invest in companies that are good for the planet and people? MSCI’s ESG ratings are like the Michelin stars for ethical investing. 🌱

Funds & ETFs Licensing - The Album Royalties: More fees roll in from funds and ETFs that are totally based on MSCI's genius indices. 💰

Managed Solutions & Platforms - The All-in-One Package: For clients who want the whole shebang, MSCI offers complete investment management platforms. 🎁

Basically, MSCI is a recurring revenue machine! They're like the gift that keeps on giving, with clients locked into long-term subscriptions, often with prices that go up a little each year. Cha-ching! 🤑

Who's Throwing Money at MSCI? - The VIP Guest List 🥂

MSCI's client list is like a who's who of the financial world. Think of it as the VIP section at a finance festival:

Asset Managers - The Big Spenders: These are probably MSCI's biggest fans. They use MSCI's indices as their go-to benchmarks and to create investment products galore. Think of them as the main acts at the festival, relying on MSCI's scorekeeping to shine. 🌟

Asset Owners - The Wise Investors: Pension funds, sovereign wealth funds, and endowments are the super-smart, long-term investors. They use MSCI's tools for the really big decisions, like where to put their money for decades to come. Think of them as the festival organizers, making sure everything runs smoothly for the long haul. 🧠

Banks & Trading Firms - The Fast-Paced Players: These are the speed racers of finance, using MSCI's data for quick trades, managing risks, and creating fancy financial products. Think of them as the food trucks at the festival – fast, dynamic, and always on the move. 🚀

MSCI's clients are all over the globe, making them a truly international sensation!

MSCI's Global Jam Session - Where Do They Rock Out? 🌍

MSCI is a global band, playing gigs all over the world! Their revenue is spread across different continents. As of late 2024, their subscription run rate by region looked like this:

The Americas (USA, Canada, Latin America) - 45%: Like their home base, where the party's always pumping! 🇺🇸🇨🇦

EMEA (Europe, Middle East, Africa) - 38%: A huge fanbase across a diverse and buzzing region. 🇪🇺🌍

APAC (Asia-Pacific) - 17%: A rapidly growing fanbase in the exciting Asian markets. 🌏

And guess what? In the last quarter of 2024, every region was grooving to the MSCI beat, with solid growth everywhere! It's like their music is topping charts worldwide! 📈

Market Mayhem - Who Else is on Stage? 🎤

MSCI isn't the only act in town. The financial data and analytics scene is a crowded stage with some major players:

FTSE Russell - The Long-Time Rivals: Think of them as the other veteran band, also rocking the index scene and data services. rival band, also rocking the index scene and data services. 🎸

S&P Global - The All-Rounders: These guys are like a supergroup, doing indexes, ratings, and tons of analytics. 🌟

Bloomberg - The Data Giants: Bloomberg is like the mega-festival itself, providing pretty much everything financial – data, news, analytics, you name it! 🎪

Refinitiv (London Stock Exchange Group) - The Infrastructure Crew: They're like the stage crew, providing the essential data and tech infrastructure for the financial markets. 🛠️

These are the main bands MSCI jams with (and competes against!) in the financial data arena.

Growth Spurt - Are They Still Climbing the Charts? 🚀

MSCI's Future Beats:

MSCI is like a band that's still getting bigger and better! In 2022, their overall revenue jumped 10%, and their recurring subscription revenue went wild, up 16%! And in the third quarter of 2024? They were still rocking with a 15% organic subscription run rate growth! They're seeing double-digit growth across the board – indices, ESG, you name it. MSCI themselves say they see "enormous growth opportunities" everywhere! It's like they're just getting started on their world tour!

The Market's Tune:

The financial data and analytics market is like a genre that's always trending upwards. Why?

Markets Getting Wilder: Financial markets are becoming more complex than ever, so everyone needs smarter tools to navigate the craziness. 🎢

Passive Investing is Booming: ETFs and index-based investing are super popular, and that means everyone needs benchmarks (hello, MSCI!). 📈

ESG is the New Black: Investing with a conscience is in, and ESG data is hot stuff. 🔥

Tech Keeps Evolving: New tech in data and analytics is opening up fresh opportunities all the time. 🤖

Valuation Time - Is MSCI Worth the Ticket Price? 🎟️

Let's talk numbers and see if MSCI's stock is a steal or a splurge!

Valuation Breakdown - Show Me the Money! 💰

Let’s dive into the financial mosh pit and check out MSCI's value:

Stock Price - The Current Market Vibe: Right now, MSCI's stock is bouncing around $585. Think of this as the current ticket price to join the MSCI fan club (investors!). 🎫

EPS (Earnings Per Share) - The Profit Score: Over the last year, MSCI made about $15.22 per share in profit. That's like their earnings report card for the year. 🍎

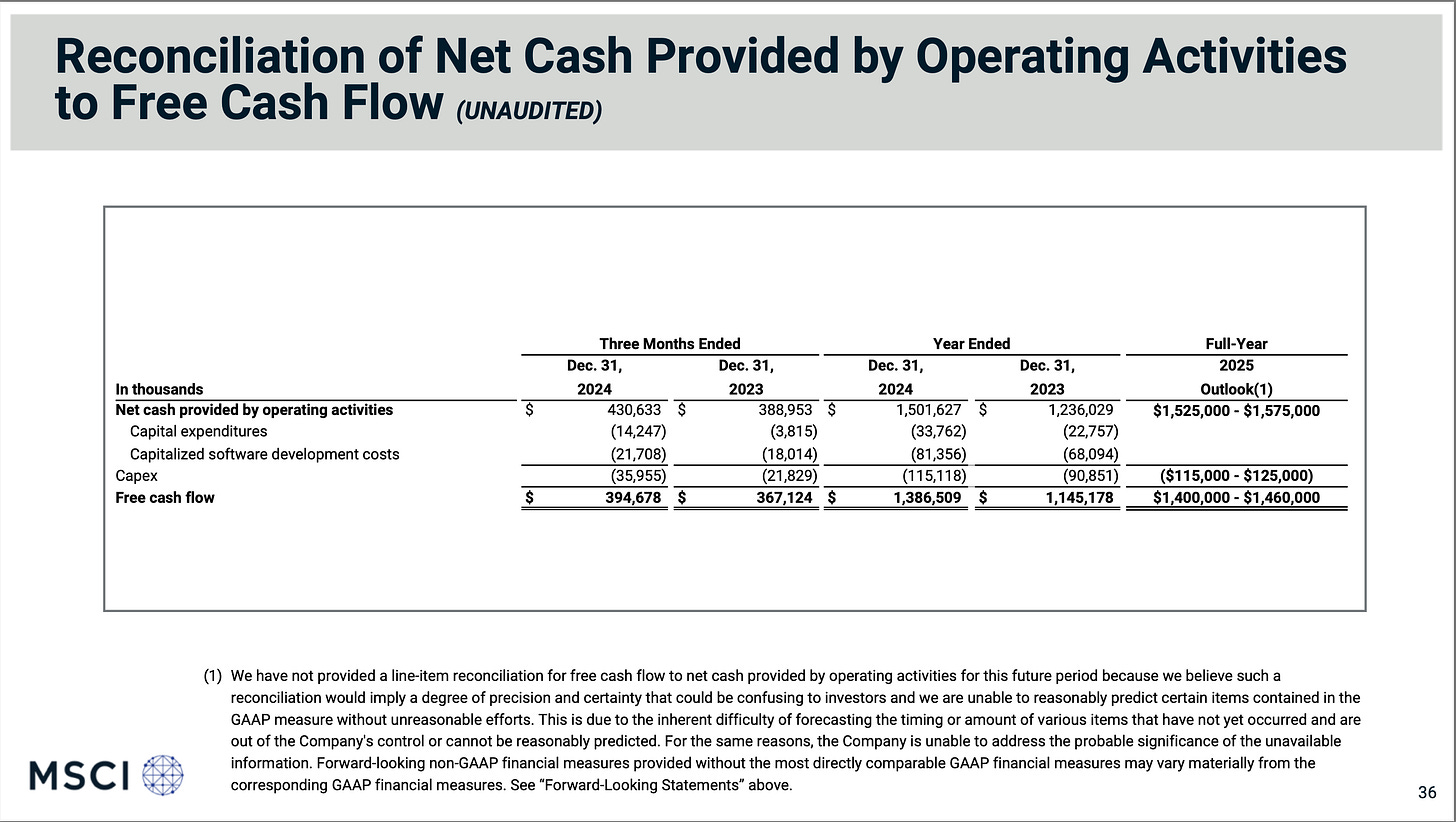

Free Cash Flow (FCF) - The Real Cash in Hand: MSCI generated a whopping $1.38 billion in free cash flow in the last year, which works out to about $17.83 per share. This is the actual cash they can play with – invest, pay back debt, or maybe throw a company party! 🎉

Free Cash Flow Yield - The Investment Return Rate:

Think of this as the "dividend" you'd get in cash flow terms, compared to the stock price. It's calculated as: ($17.83 FCF per share) / ($585 Stock Price) = around 3.0%. So, for every dollar you invest, you're getting about 3 cents back in free cash flow each year. Not bad, but let's compare… 🤔

MSCI vs. the "Safe Bet" - 10-Year Treasury Yield:

The 10-Year Treasury Yield (super safe government bond) is at 4.7%. This is like comparing MSCI's concert ticket to a super safe government bond. Right now, those bonds are paying a higher "yield" than MSCI's FCF yield. Usually, investors like higher yields for lower risk (like government bonds). But… MSCI is aiming for growth! This is a simplified view though – MSCI has growth potential that those bonds definitely don't! It's like comparing a potentially skyrocketing rockstar to a super reliable, but maybe less exciting, savings account. 🤷♀️

Balance Sheet Breakdown - Under the Hood:

Let's peek under the hood at MSCI's finances as of the end of 2024:

Cash & Equivalents - Pocket Money: MSCI has $409.4 million in cash. Think of this as their readily available "pocket money." 💵

Total Debt - The Loan Ledger: They owe $4.5 billion in debt. This is like their mortgage or student loan – a big number, but manageable? 😬

Free Cash Flow (LTM) - The Annual Income: Remember that $1.494 billion in free cash flow they generate each year? That's their annual "income" to play with. 💰

Balance Sheet Ratios - Financial Health Check:

Debt to Free Cash Flow Ratio - Debt Payback Time: $4.5 billion Debt / $1.39 billion FCF = about 3.0 times. This means it would take about 3 years of their free cash flow to pay off all their debt, if they used all of it for that. That’s generally considered pretty healthy, especially for a company with steady income like MSCI. 👍

Cash to Debt Ratio - Cash Cushion: $409.4 million Cash / $4.5 billion Debt = around 9%. They have cash to cover about 9% of their debt right now. While not a huge cash pile compared to debt, their strong cash flow is key. Think of it as having a decent emergency fund, but the real strength is in your steady paycheck. 🏦

MSCI wants to keep their debt-to-EBITDA ratio in a good zone (3.0x to 3.5x), and they're currently below that, so they're managing their debt like pros. 😎

What about their needed growth to give you 15% CAGR?

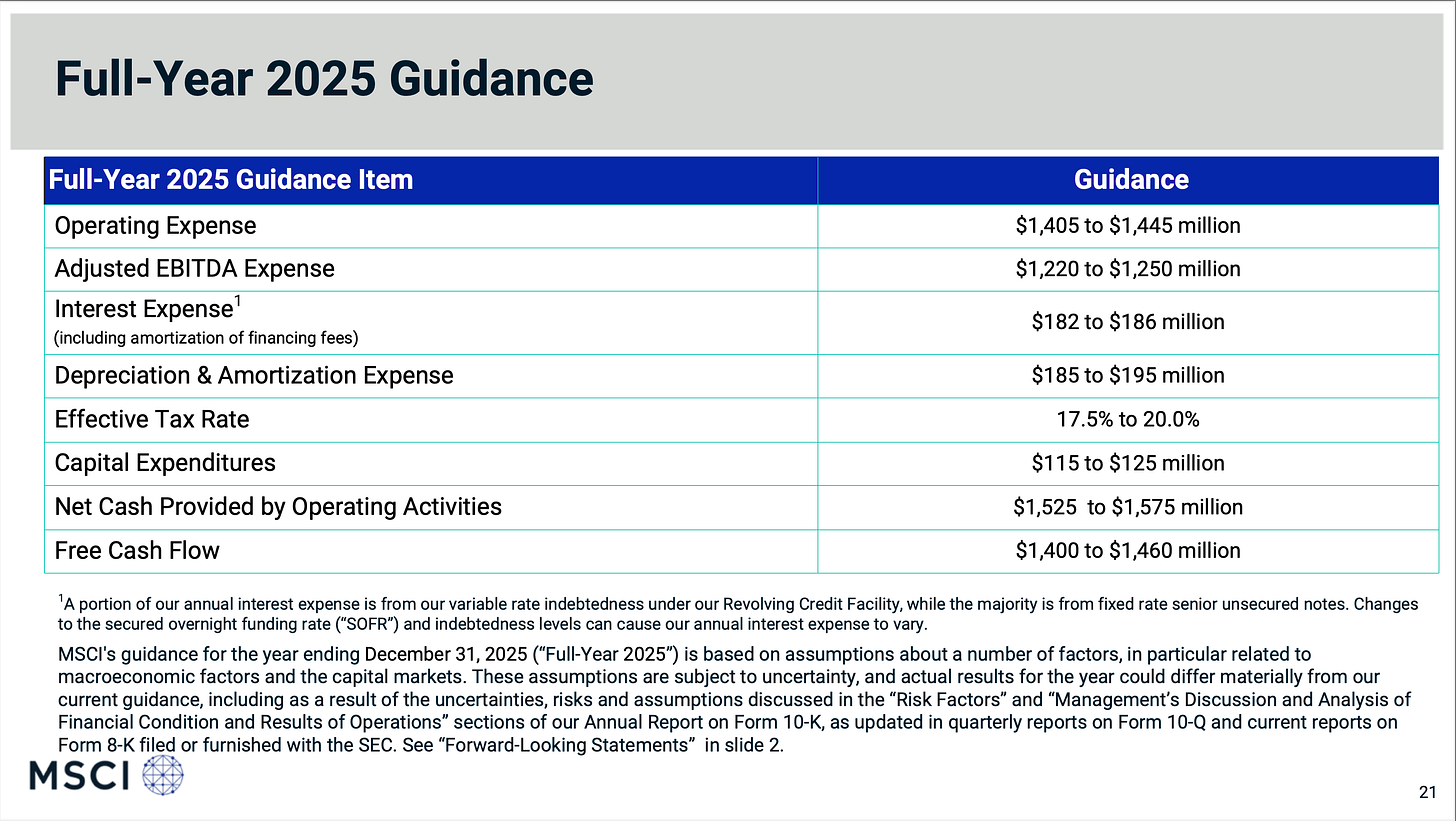

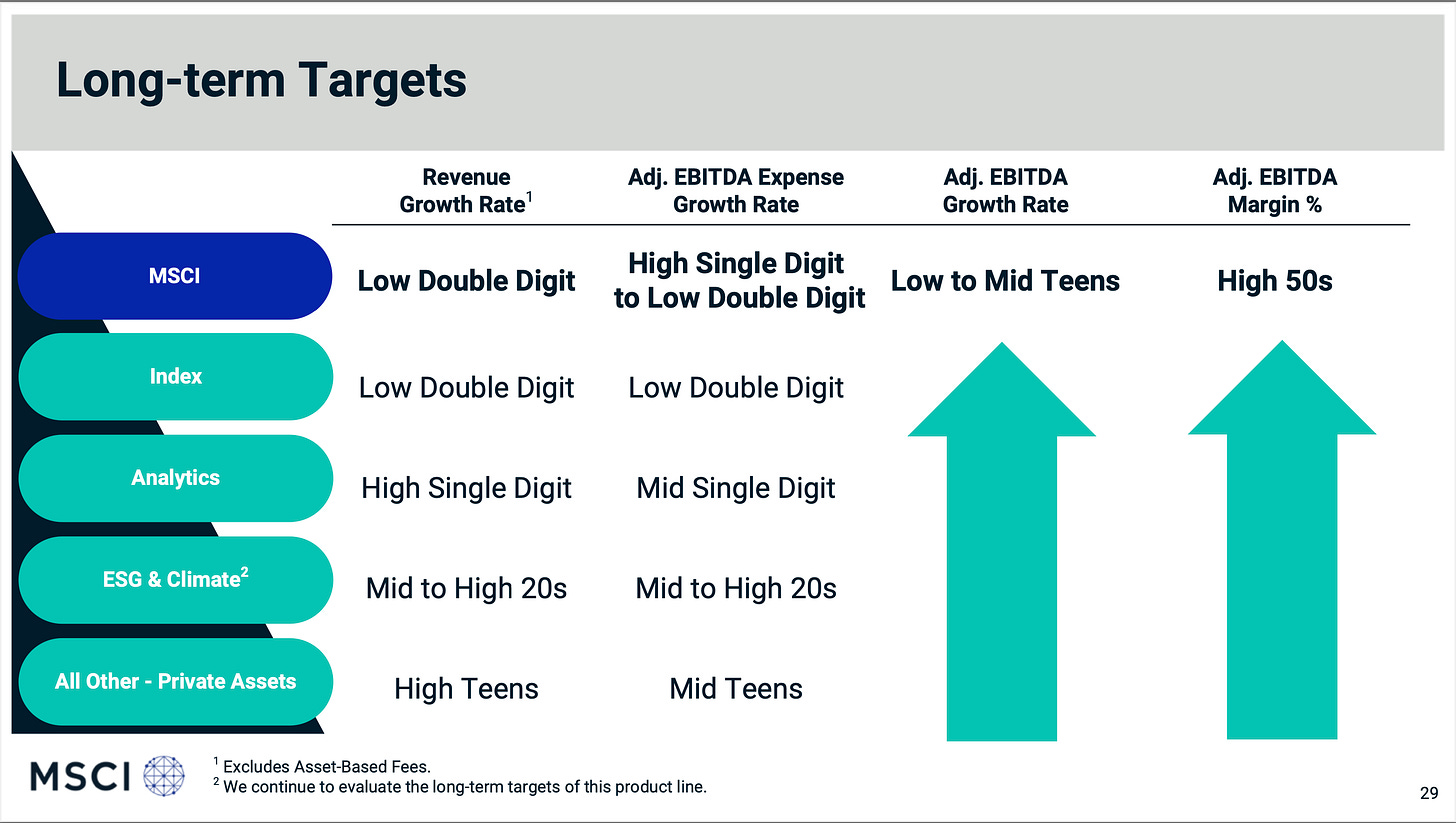

Like every year MSCI gave their Guidance, the business is so recurring and so predictable, that they’re not far off when they announce something

This means that in 2025 they will grow FCF by 1-5% and they even showed it in their 2024 FY results, you don’t even need to dig to find it.

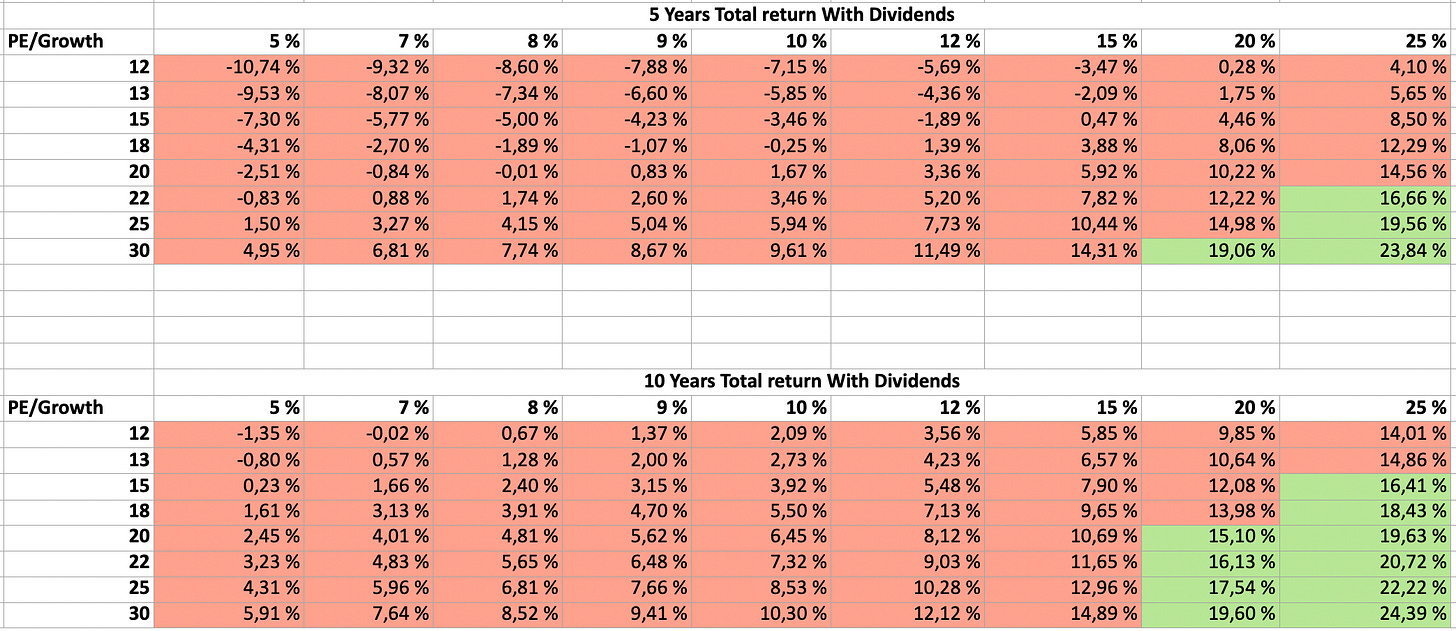

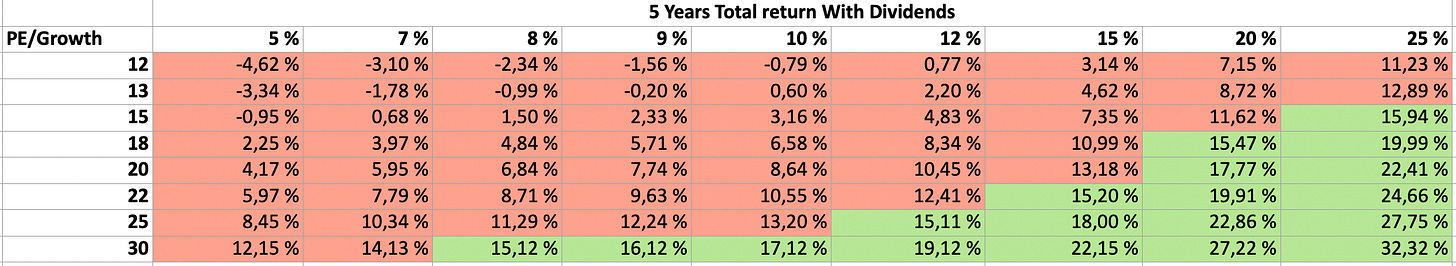

Let’s bring our CAGR estimation tool, 1,5B in FCF is around 18$ per share (without any share buyback) on average they buyback 1.6% of the outstanding share each year so that’s negligible :

You start to understand how this table works, it shows you the FCF growth they need to achieve and the final Price to free cashflow that you need.

As you see, it doesn’t look that good on a valuation perspective, to achieve at least 15% CAGR you’ll need 20% FCF growth and a final PE of 25 for 5 years, or 15% growth for 10 years and a final PE of 30.

Now the PE on the 5 years side look really reasonable, but the growth rates, meh, to give you a bit of history here’s the average growth in the past decade :

3Yr : 17.3% 5Yr : 16.3% 10Yr 19.2%.

Now don’t get me wrong those are really good numbers. But Remember that you need 20% for at last 5 years. that’s what bothers me, the price is too high to justify the low to mid teens growth that they will have, they’re valued like they will grow 20%+ where in reality it will be in the 10-15% range.

And i’m not the one saying it, they do. They plan to have low to mid teens Adj EBITA growth (I fucking hate when companies talk about EBITA).

Add on top of that a shareholder yield of around 2.5% that means you’re looking at 12.5-17.5% EPS growth in the long term.

And that’s why in my article that talked about their Q4 results, I said that i’m not buying unless the price goes below 450$. And I don’t need give you a 10 lines explanation here but only this, here the same dashboard but with a price of 420$.

at 420 we can achieve 15% CAGR with only 12% growth (their low range) and a final PE of 22 in our 5 years timeframe, that leaves us with a lot of margin of safety since they target on a per share basis 12,5-17,5%.

But with 22 P/FCF we’re really pessimistic, a company like that should be in the 23-27 P-FCF (currently at 34).

The Encore - MSCI in a Nutshell:

MSCI is a solid company with a killer business model, rocking it in a growing market. While their current "yield" might not be as flashy as super-safe bonds, they've got growth potential, a loyal fanbase (clients!), and they're handling their finances like seasoned rockstars. But the price is too high for me, paying 34 times the FCF with a low to mid teens FCF growth in not the right price for me. A company like that should be in the 22-27, not at 34. But I can understand the valuation, the business is recurring, super predictable and the margins are sky high.

I had the opportunity last year to buy at 450 but I didn’t had cash on hands, my bad, i’ll have to wait for another time! As Peter Lynch always said, price tend to follow earnings, so when investors will understand that earnings are not gonna do +20% each year the price will come down a bit.

It’s a pass for me, but i’ll keep an eye on it to pull the trigger if the price drops.

Want to read more?

Don’t forget to share and subscribe, for the love of all that is holy! My family is threatening to eat me if I don't bring home the bacon (or the clicks)!

We've got fresh articles dropping every Tuesday and Thursday! Tuesdays are your day for a dose of market magic, covering everything from the hottest trends to personal finance tips (we'll even throw in the occasional meme, just for kicks). But hold onto your hats, because Thursdays, that's when we unleash the Deep dive – earnings calls, hot-off-the-press reports, and all the juicy market happenings you need to know, served up with a side of serious analysis. So, grab your Tuesday treat, and then consider joining the club for the Thursday feast!

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.