Adyen and Kinsale FY 2024: Earnings that Moved the Market

Earnings season continues for our portfolio, 2 of our companies released their earnings let's have a look at the key Highlights and Analysis

Quick reminder : I recently released a book called "Investing with Eagles." 🦅 It dives deep into the strategies I've used to navigate the market and achieve my own financial goals. We just entered the top 300 books on portfolio management and investments in Amazon! If you're ready to soar to new heights, grab your copy on Amazon.

Adyen's H2 2024: A Celebration of Success and a Toast to the Future!

Adyen, the financial technology rockstar that's shaking up the industry, just released its full-year and H2 2024 results, and let me tell you, they're off the charts!

Let's start with the grand finale, shall we?

FY2024: The Year Adyen Took the World by Storm!

Net revenue: A whopping €1,996.1 million! That's a 23% surge compared to the previous year.

Net income: An astounding €925.2 million! This 32% jump proves that Adyen knows how to turn revenue into serious profit. Ka-ching! 💰

EBITDA: €992.3 million, a 34% leap! Those profit margins are looking as impressive as a mountain peak.

Free cash flow: A cool €859.8 million, representing a 34% increase! Talk about a money-making machine! 💸

Number of platform processing over 1 billion : 28 (up 30%)

But Adyen's success isn't just about the Benjamins, baby. It's about building those unshakeable bonds with the biggest names in the business.

And don't forget about their global domination tour! Adyen is planting its flag in exciting new markets like India, and they're not afraid to push the boundaries with their innovative tech.

H2 2024: The Party Continues!

But wait, the celebration doesn't stop there! Let's zoom in on H2 2024, where the Adyen party really got started:

Net revenue: €1,082.7 million! That's a 22% jump compared to the same period last year. Someone pass the champagne! 🍾

EBITDA: €569.2 million, a 35% surge! Those profit margins are looking as delightful as a perfectly baked pie. 🥧

Regional Roundup: EMEA stole the show with a 27% growth, but let's give it up for all the regions who contributed to this amazing performance. One big global high-five! 🖐️

Adyen's H2 was a whirlwind of customer wins, product launches, and global expansion. They're like the ultimate party host, making sure everyone has a good time while quietly orchestrating a symphony of success behind the scenes.

Outlook for 2025 :

Adyen anticipates a slight acceleration in its annual net revenue growth rate compared to 2024. They plan to continue expanding their team to support strategic growth in key regions. While this means increased hiring, they expect net revenue to outpace the growth of their workforce, leading to further expansion of their EBITDA margin in 2025.

Valuation and will we buy more ?

Okay, so you're already head over heels for Adyen and want to grab more shares? Smart move! But timing is everything, right? Let's dive into those juicy metrics and figure out the perfect price to swipe right on Adyen.

ROIIC: Adyen's Money-Printing Machine!

Forget boring old savings accounts. Adyen's turning invested capital into pure profit at an astonishing rate!

In 2023, they invested €2.4B and generated a cool €700M in profit. That's a 29% ROIC!

They didn't stop there! In 2024, they plowed back €734M, bringing their invested capital to €3.1B. And what did they conjure up with that? A whopping €925M in profit (29 per share)!

So, with that extra €734M investment, they basically conjured up an extra €225M in profit (€925M - €700M). That's an ROIIC of 30%! They're basically printing money faster than you can say "unicorn"!

So if they keep the same rate for 2025 we’re looking at a total invested capital of 4.2B and an extra 300M in earnings next year, bringing the total net income to 1.2B or around 38 per share, a 30% increase again.

What’s the right price?

Ok so 2024 was excellent and 2025 will also be, so now the big question is at what price do we buy more than we already have?

Current PE is : 61

Forward PE : 46

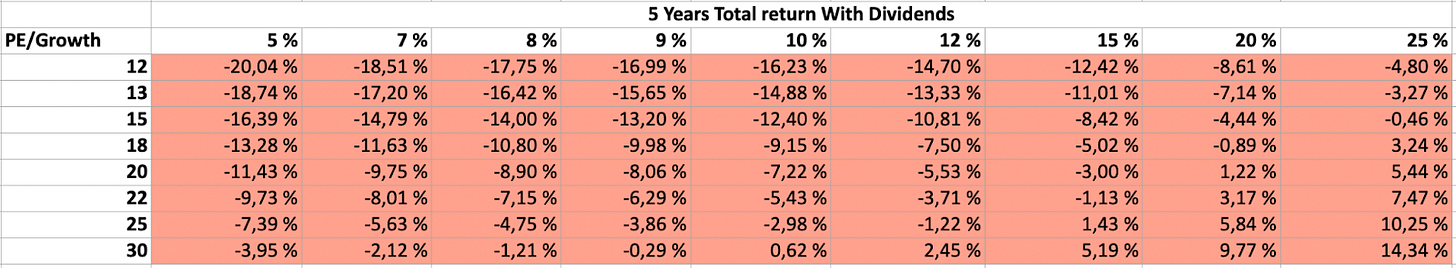

Let's bring our famous dashboard

Okay, so you're smitten with Adyen, but that price tag is making you sweat? I feel you! It's like falling for a luxury sports car when you're on a bicycle budget. 😩

The Pricey Problem: When a Good Thing Costs Too Much

You snagged those Adyen shares back in late 2023 when the stock was a steal, trading at a PE of 35. Ah, those were the days! But now? Even with their impressive 25% annual growth projected for the next 5 years, you'd need a PE of 30 just to achieve your 15% CAGR target. And let's be real, with the current PE being 61, that's a whole lotta hopium!

High-Flying PEs: A Risky Romance

And here's the thing about those sky-high PEs: they're like a summer fling, exciting but fleeting. History shows that companies rarely maintain those nosebleed valuations for long. So, expecting that PE to stay inflated? That's like hoping your Tinder match looks exactly like their profile picture. We've all been there.

15% CAGR: Is It Worth the Risk?

You're a savvy investor, and you know you can score that 15% CAGR with less risky opportunities. Why bet the farm on a high-flying PE when you can play it safe and still reach your goals? It's like choosing a reliable partner over a hot-and-cold lover. Sometimes, boring is better!

FCF Yield vs. 10Y Yield: A Reality Check

And let's not forget that juicy 10Y yield sitting at 4.5%. Adyen's forward FCF yield of 2.7%? Not so tempting anymore, is it? Even with their mid-twenties growth, they'd need to keep that pace up for 3 years just to match the 10Y yield. It's like comparing a delicious home-cooked meal to a fast-food burger. Sure, the burger is tempting, but the home-cooked meal is where the real value is.

The €1400 Dilemma: Still Too Rich for Your Blood

Even at €1400 per share, Adyen would need to maintain that 20% growth for 5 years and land a final PE of 30 just to deliver a 15% CAGR. That's a lot of "ifs" for a love that's already costing you a premium. It's like buying your significant other a diamond necklace when you're still paying off student loans. Priorities, people!

The Final Verdict: Time to do nothing

Adyen's a fantastic company, no doubt. But at the current price? It's just not the right fit for my investment strategy. There's no shame in walking away from a love that's become too expensive. I’ll keep my shares and keep an eye on it for sure, but don't be afraid to explore other opportunities that offer a better balance of risk and reward. After all, there are plenty of fish in the sea!

Kinsale Capital Group: A Year of Growth (and a Few Expenses Along the Way)

Let's give Kinsale Capital Group the celebratory tone they deserve! Here's a fun rewrite of their Q4 and full-year 2024 highlights:

Kinsale Capital Group CRUSHED IT in Q4 2024! Check out these stellar results:

Diluted earnings per share hopped up 5.6% compared to Q4 2023. Not too shabby!

Diluted operating earnings per share? A 19.4% leap! Way to go, Kinsale!

Gross written premiums surged 12.2% to a hefty $443.3 million. That's how you do it!

Net investment income soared 37.8% to $41.9 million. Cha-ching!

Underwriting income hit a sweet $97.9 million, resulting in a combined ratio of 73.4%. Impressive!

And now, for the grand finale – Kinsale Capital Group's full-year 2024 highlights:

Diluted earnings per share rocketed up 34.5%! Kinsale's on fire!

Diluted operating earnings per share also jumped an amazing 28.5%. High fives all around!

Gross written premiums reached a whopping $1.9 billion, a 19.2% increase. Kinsale's a powerhouse!

Net investment income? Up a phenomenal 46.9% to $150.3 million! They're killing it!

Full-year underwriting income landed at a fantastic $325.9 million, with a combined ratio of 76.4%. Solid performance!

And the cherry on top? Operating return on equity of a dazzling 29.2%. Kinsale nailed it!

What happened to the stock?

Well the stock tanked 6%, and it’s pretty obvious why, Q4 2024 Diluted operating earnings per share grew 19.4% compared to Q4 2023. BUT this is due to last year Q4 EPS that was low due to Change in fair value of equity securities, after taxes, per share that took down the real EPS to 3.87$ for Q4 2023. In reality operating earnings for Q4 2023 was 4.43$ and so when you see that this year is 4.68$, And for them it’s bad, we expected a big growth like the previous quarter.

But what happened to the business?

Okay, so Q4 revenue did jump a respectable 17%. Woohoo! But... expenses also decided to join the party, and they brought a few extra friends. They climbed 23%, which, well, is a bit of a "whoa there" moment. It seems expenses were a tad enthusiastic this quarter.

And if we want to get really specific, it's those pesky losses and loss adjustment expenses that are the real culprits, sprinting ahead with a 21% increase. This, understandably, put a squeeze on margins, and net income only inched up 5.8%. Hmm.

So, should we all start panicking and running around like chickens with our heads cut off? Absolutely not! This is the insurance biz, folks. It's not exactly known for its predictability. Sometimes you have good quarters, sometimes you have...less good quarters. It's the nature of the beast. A few bumps in the road don't mean it's time to abandon ship. Patience, grasshopper!

Let's talk ROE and return on incremental capital.

Stockholders' equity grew from $1.1 billion to $1.5 billion. Book value per share also saw a nice jump, going from $46.88 to $63.75. That's some solid growth! Operating ROE for the full year did dip slightly, from 31.8% to 29.2%. But, as Kinsale themselves point out, this is mostly because they've been so darn profitable that their average stockholders' equity has grown. It's a "good problem" to have! So, no need to sound the alarm bells just yet. Keep calm and carry on!

Where are we going from now and what can we expect?

Well that was a question in the earning call, and the CEO answer was down to earth I really like that « I think that 10% to 20% growth is a conservative and good faith estimate as to where we go from here. I think if you look back over 5 years when we were growing at a 40% clip, that was driven in large part by our business model »

10 to 20% is a large range but it’s normal, even as a CEO you get a rough idea of where you’re going but you cannot know for sure in a business that is not predictable.

What’s our price point?

So Kinsale is currently selling for 25 times earnings, not too bad for a company growing like they do but hey it's an insurance business, so this PE will go down with time, try to find another insurance company that is selling for 25 times earnings!

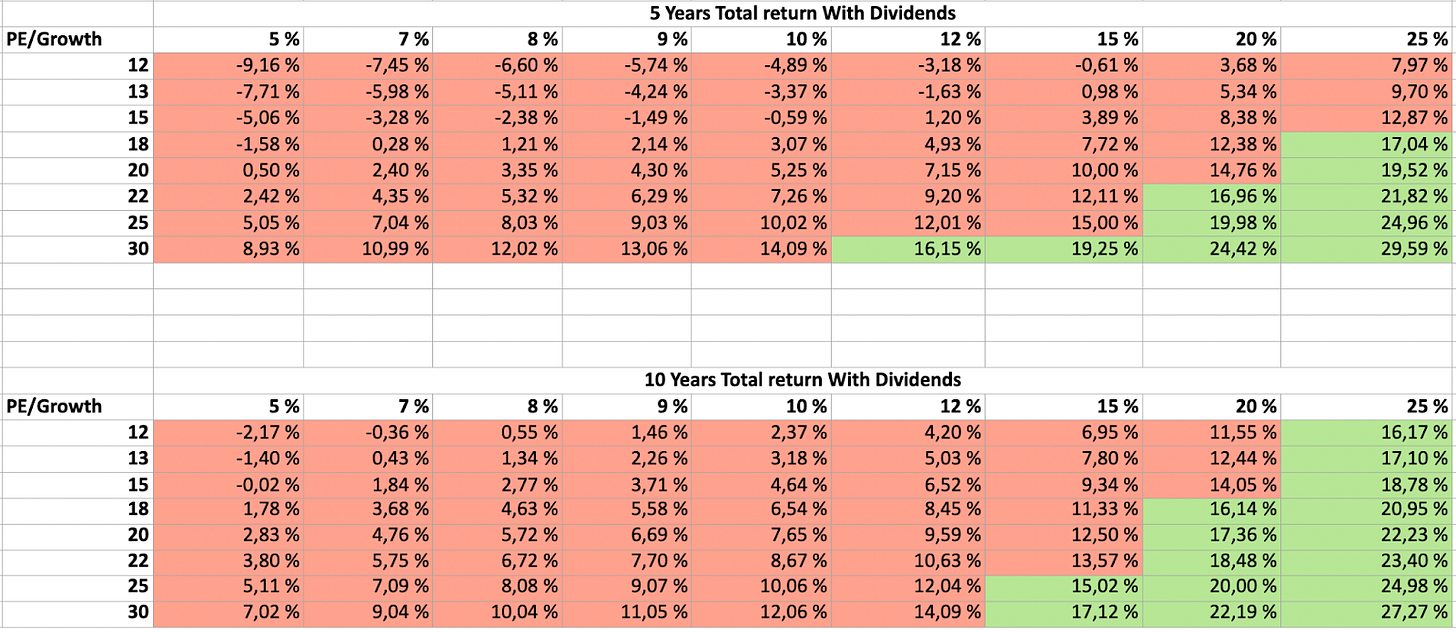

let’s bring our dashboard :

What needs to happen to have a minimum of 15% CAGR ?

Well it’s quite simple there is 3 scenarios :

Kinsale needs to grow earnings at 15% and keep a PE of 25

Kinsale grow 20% per year and the PE get lowered to 22

Kinsale grow 12% per year but the PE goes to 30 (less likely scenario)

Those 3 scenarios are possible, but I personally think that the first one is the most probable because for me a company growing at 15% per year should have a PE somewhere between 20 and 25, so we’re in the high range here. We need some margin of safety.

Therefore i’ll start loading more when the price will be around 400 this means a PE of 22 and a earning yield around 4,5% so very close to the 10Y treasury.

With a price of 400, Kinsale needs only 12% growth with a final PE of 25 or 15% growth with a final PE of 22. So exactly in the low to mid range of the CEO estimations.

The stock dropped a lot this week, and we’re not that far from this price point, a 10% drop can make the stock very appealing.

Don’t forget to share and subscribe, for the love of all that is holy! My family is threatening to eat me if I don't bring home the bacon (or the clicks)!

Want to read more here’s our best of the month ?

We've got fresh articles dropping every Tuesday and Thursday! Tuesdays are your day for a dose of market magic, covering everything from the hottest trends to personal finance tips (we'll even throw in the occasional meme, just for kicks). But hold onto your hats, because Thursdays, that's when we unleash the Deep dive – earnings calls, hot-off-the-press reports, and all the juicy market happenings you need to know, served up with a side of serious analysis. So, grab your Tuesday treat, and then consider joining the club for the Thursday feast!

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.

Interesting write up, but IMHO a flawed conclusion. There are fundamental flaws in price centric investing with earnings multiples as your guiding light. Most people missed the meteoric rise of Amazon because they wrongly concluded that it had a PE of ~70x and was too expensive. Meanwhile a $10,000 investment in 2009 would be worth over $15 million today. For a break down, please see: https://rockandturner.substack.com/p/the-fallacy-of-price-centric-investing